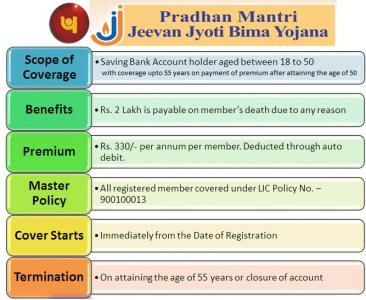

Pradhan Mantri Jeevan Jyoti Bima Yojana High insurance costs in India make it challenging for people to buy insurance. Hence, the government introduced budget-friendly plans, such as the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY).

With an annual premium of Rs 436, which equals Rs 36 monthly, this scheme aims to offer affordable life insurance to individuals.

Under this scheme, the family receives Rs 2 lakh if the insured person passes away. It is available for individuals aged 18 to 55 years. The scheme operates from June 1 to May 31 annually. Having a bank account is necessary to receive the benefits. If your account is closed or lacks sufficient funds during premium deduction, your insurance might get cancelled.

Pradhan Mantri Jeevan Jyoti Bima Yojana

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) offers life insurance coverage for one year and requires annual renewal. This policy provides a Rs 2 lakh payout to the nominee in case of the insured’s death, regardless of the cause. No medical test is necessary to attain this insurance. However, it is important to mention in the consent letter that you are not suffering from certain specified diseases.

The premium for the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) must be paid all at once. The policy runs from June 1st to May 31 every year, and the annual premium is Rs 436. If you enrol in PMJJBY at the beginning of the year, the premium will be based on the date they applied, not when the money is deducted from their account.

The scheme is open to citizens aged 18 to 50 years. If you have several accounts in different banks or post offices, you can only enrol in this insurance using one account. To enrol in PMJJBY, your bank account must be linked to your Aadhaar number.

The Pradhan Mantri Jeevan Jyoti Bima Yojana has recently launched a new auto-renewal feature to help policyholders with their premium payments. Under this scheme, next year’s premium will be automatically deducted from your account after your current policy ends.

If you choose Automatic Renewal, Rs 436 will be deducted annually between May 25 and May 31. Insurance coverage begins after a 45-day waiting period from policy issuance, unless there’s a death due to an accident, in which case the waiting period is waived.

Pradhan Mantri Jeevan Jyoti Bima Yojana Scheme: Benefits and How to Apply Online

PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana) is an annual renewal life insurance scheme providing ₹2,00,000 coverage for the policyholder’s demise. The premium is just ₹330 per year, making it highly affordable. It aims to extend life insurance benefits to the masses, particularly the underprivileged and the economically weaker sections, ensuring financial security for families in the event of any unforeseen circumstances. In this article, we’ll explore the different aspects of the PMJJBY scheme.

Pradhan Mantri Jeevan Jyoti Bima Yojana: The Indian government offers life insurance under the Pradhan Mantri Jeevan Jyoti Bima Yojana. The Honourable Prime Minister of India, Narendra Modi, unveiled this program in Kolkata on May 9, 2015.

Pradhan Mantri Jeevan Jyoti Bima Yojana: objective, Benefits, Eligibility and All Information

The Indian government launched a new life insurance scheme called the Pradhan Mantri Jeevan Jyoti Bima Yojana to assist the poor and disadvantaged groups. The Pradhan Mantri Jeevan Jyoti Bima Yojana is a pure-term insurance plan available to individuals between 18 and 50.

The Pradhan Mantri Jeevan Jyoti Bima Yojana is an annual renewal term insurance policy offering life insurance coverage. If an insured individual passes away unexpectedly, the insurance provider offers

The Central Government revised the Pradhan Mantri Jeevan Jyoti Bima Yojana premium rates on May 31, 2022. Due to the long history of adverse claims experiences, the decision has been made to increase the cost of this plan’s premiums. This scheme’s beneficiaries will now have to pay a daily premium of ₹ 1.25. Under this, the monthly premium will now be ₹ 436 instead of ₹ 330. 2015 saw the launch of this program. For the past seven years, there has been no change to the premium rate under this scheme. The number of active participants in this scheme as of March 31, 2022, is 6.4 crore.

Prime Minister Jeevan Jyoti Insurance Scheme Premium Amount

All citizens, including those in the EWS and BPL, are eligible for reasonable premium rates under this program. Under the Pradhan Mantri Jeevan Jyoti Bima Yojana, insurance coverage will begin on June 1 and run through May 31 of the following year. A medical examination is not necessary for PMJJBY to purchase insurance.

- Insurance premium to LIC/Insurance Company: Rs 289/-

- Reimbursement of Expenses for BC/Micro/Corporate/Agent: Rs. 30/-

- Reimbursement of Administrative Charges of Participating Bank: Rs 11/-

- Total Premium: Rs 330/- only

Details of PMJJBY Scheme 2023

| Name of the Scheme | Prime Minister Jeevan Jyoti Insurance Scheme |

| started by | by central government |

| Beneficiary | citizens of the country |

| Objective | Providing Policy Insurance |

| official website | https://www.jansuraksha.gov.in/https://www.jansuraksha.gov.in/ |

The objective of Pradhan Mantri Jeevan Jyoti Bima Yojana

For those in the nation who wish to give their family social security even after they pass away, this is an excellent plan. Following the PM Jeevan Jyoti Insurance Scheme, following the policyholder’s passing

between the ages of 18 and 50, The government will provide the policyholder’s family with Rs 2 lakh under the scheme, enabling them to lead a comfortable life. Indian citizens will be covered under PMJJBY through this scheme. This program will provide insurance to more people than just the underprivileged and impoverished.

Pradhan Mantri Jeevan Jyoti Bima Yojana Death claims received in the last 5 years

SunDeath Claims ReceivedAmount Distributed2016-1759,118Rs 1,182.36 crore2017-1889,708Rs 1,794.16 crore2018-191,35,212Rs 2,704.24 crore2019-201,78,189Rs 3563.78 crore2020-211,78,189Rs 4698.10 crore

In which situations will the benefit of the Jeevan Jyoti Bima Yojana not be provided?

- if the bank account of the beneficiary is closed.

- if the bank account is devoid of the premium amount.

- after turning 55 years old.

Benefits

- The country’s citizens, who are between the ages of 18 and 50, are eligible to participate in this program.

- Under this scheme, PMJJBY may be annually renewed for the policyholder’s family following the policyholder’s passing. This scheme requires a 330-rupee annual premium from its members. A two-lakh-rupee life insurance policy will be given.

- The candidate must apply for this scheme to receive the benefits of PMJJBY.

- This plan requires that the annual premium be paid by May 31st of each year that the coverage is in effect.

- The policy can be renewed by submitting a lump-sum payment of the full annual premium along with a payment plan if the annual premium cannot be deposited before this date.

Some main points of Jeevan Jyoti Bima Yojana

- It is possible to purchase the Pradhan Mantri Jeevan Jyoti Bima Yojana without having to go through a medical examination.

- A minimum of 18 to 50 years old is required to purchase a PM Jeevan Jyoti Insurance Scheme.

- For PMJJBY, 55 is the maturity age.

- An annual renewal of this program is required.

- Under this scheme, there is ₹200,000 in insurance.

- The Pradhan Mantri Jeevan Jyoti Bima Yojana has an enrollment period that runs from June 1 to May 31.

- It takes 45 days after Android is completed to make a claim. After 45 days, you can submit a claim.

Eligibility for Pradhan Mantri Jeevan Jyoti Bima Yojana

- The citizens who enroll in this scheme should only be between the ages of 18 and 50.

- Under this tram plan, the policyholder will have to pay an annual premium of Rs 330.

- For the policyholder to participate in this program, they must have a bank account. because the recipient’s bank account will receive the government’s donation directly.

- Every year on or before May 31st, the subscriber must have the necessary amount in their bank account at the time of the auto debit.

Jeevan Jyoti Insurance Scheme Documents

- applicant’s Aadhar card

- identity card

- bank account passbook

- mobile number

- passport-size photo

How do I apply for the Pradhan Mantri Jeevan Jyoti Insurance Yojana?

The steps listed below should be followed by any interested national beneficiaries who wish to apply to receive benefits from the Jeevan Jyoti Bima Yojana.

- Initially, you need to visit Jan Suraksha’s official website.

- How do I claim the Pradhan Mantri Jeevan Jyoti Bima Yojana?

- Under the Jeevan Jyoti Bima Yojana, the nominee of the insured person may file a claim following their passing.

- Following this, the policyholder’s nominee should get in touch with the bank first.

- The nominee must then pick up the Pradhan Mantri Jeevan Jyoti Bima Claim Form and Discharge Receipt from the bank.

- Next, the claim form, discharge receipt form, photos of the death certificate, and a voided check must be turned in by the nominee.

- The process of downloading forms

- The first place you should go is the official Pradhan Mantri Jeevan Jyoti Bima Yojana website.

- You will now see the home page load.

- Following this, you will need to select the “publicity” option.

- A new web page will now appear on your display screen.

- The clicking-release textual content that appears on this page is your desire.

- Relevant data will appear on your PC display screen.

The process of viewing rules

- The official Jeevan Jyoti Bima Yojana website must be visited first.

- The main page will now appear to you.

- After that, you’ll have to choose the rules option.

- The complete set of rules will now appear on your screen.

- You must select the option from this list that best fits your needs.

- Information pertinent to the situation will appear on your computer screen.

Pradhan Mantri Jeevan Jyoti Bima Yojana Exit

- After leaving the Jeevan Jyoti Bima Yojana, anyone is eligible to re-enroll in the program. Re-enrollment in Pradhan Mantri Jeevan Jyoti Bima Yojana requires payment of the premium and submission of a self-declaration about health. Anyone who pays the premium and submits the self-declaration can re-enroll in this program.

Helpline Number

We have given you all the pertinent details about the Pradhan Mantri Jeevan Jyoti Bima Yojana in this article. The Pradhan Mantri Jeevan Jyoti Bima Yojana helpline number can assist you in resolving any issues you may be having. 18001801111 / 1800110001 is the helpline number.